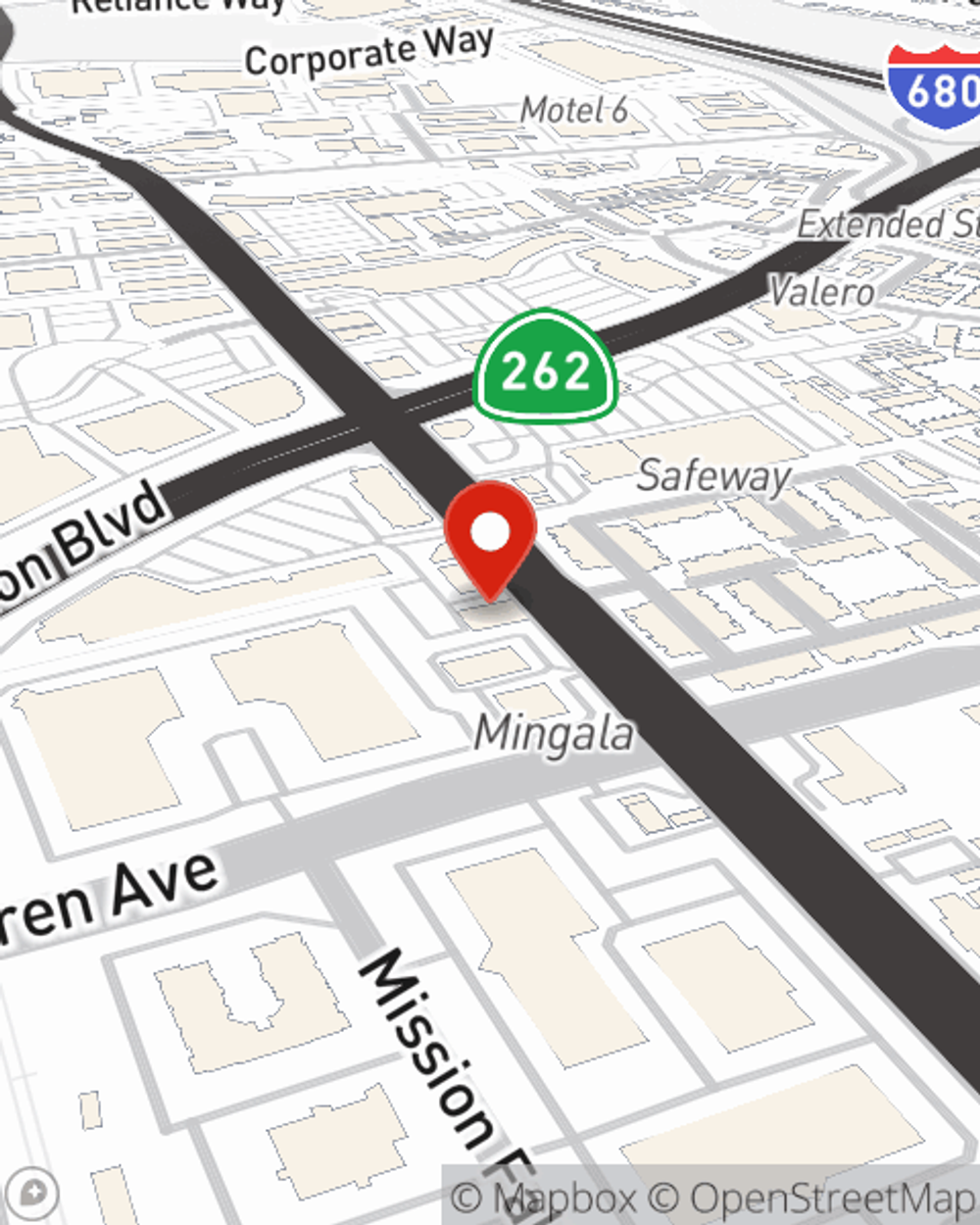

Condo Insurance in and around Fremont

Here's why you need condo unitowners insurance

Condo insurance that helps you check all the boxes

Welcome Home, Condo Owners

When it's time to relax, the home base that comes to mind for you and your family and friendsis your condo.

Here's why you need condo unitowners insurance

Condo insurance that helps you check all the boxes

Why Condo Owners In Fremont Choose State Farm

We get it. That's why State Farm offers fantastic Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Tina Vu is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that provides what you need.

Don’t let worries about your condo keep you up at night! Contact State Farm Agent Tina Vu today and see how you can meet your needs with State Farm Condominium Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Tina at (510) 979-9599 or visit our FAQ page.

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.